Welcome to the third government shutdown of 2018! Did you forget about the first two? In January, there was a three-day closure, and then in February, there was the one-day sequel. In both of those instances, investors shrugged off the news and stocks actually edged up during those days-long shutdowns.

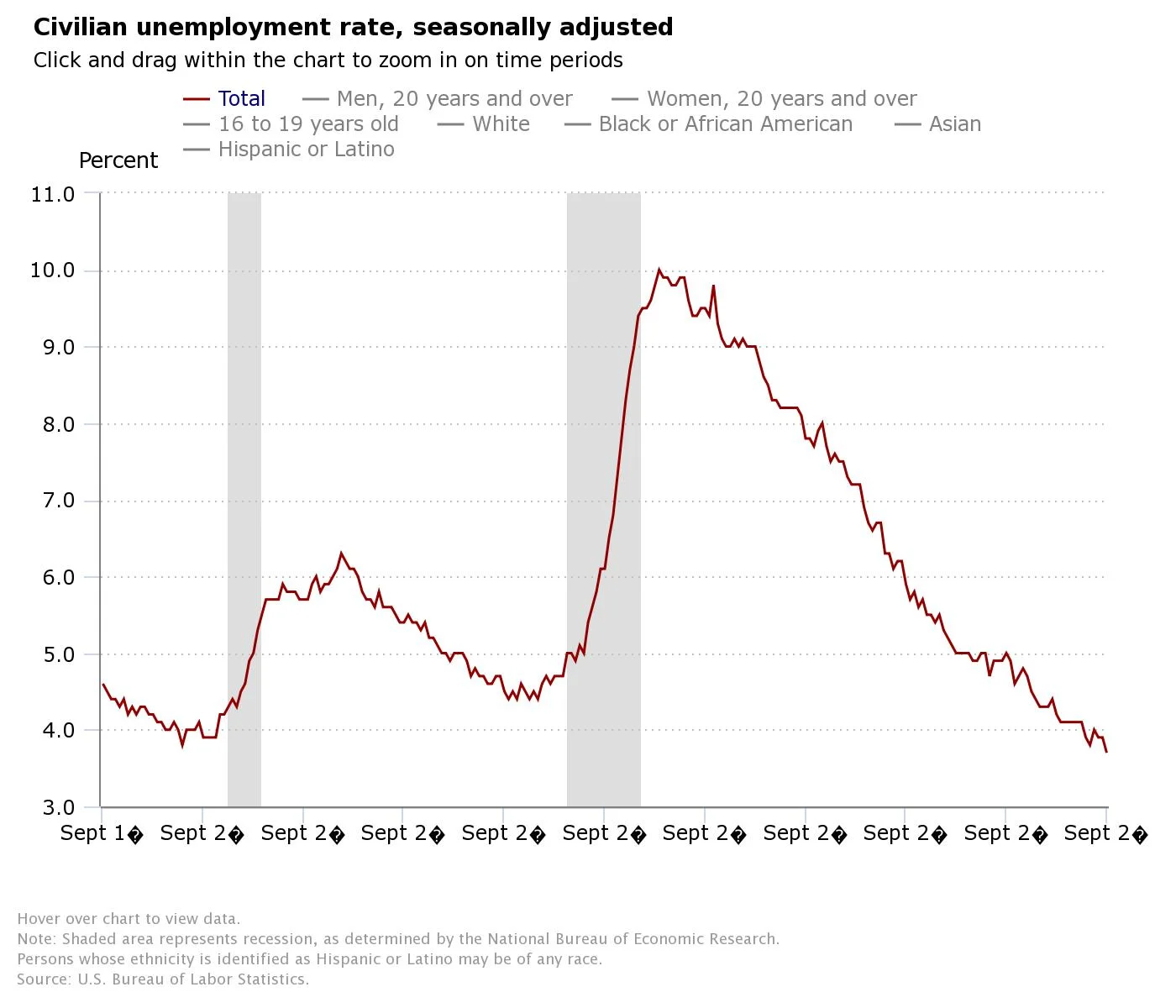

Read MoreThe last time the U.S. unemployment rate was this low, Peter, Paul and Mary’s “Leaving on a Jet Plane” was the number one song, “Hello Dolly” was the big holiday movie hit and war continued to rage in Vietnam. In December 1969, the unemployment rate was 3.7 percent and not until this September, has it been as low since.

Read MoreIf you feel like things are more expensive, you are right. Despite a slightly weaker than expected inflation report in April, this year, prices have accelerated faster than Fed officials anticipated just a few months ago. Last week we learned that headline inflation increased to a 14-month high of 2.5 percent from a year ago in April, due in large part to rising gas prices. Excluding food and energy the core rate increased by 2.1 percent.

Read MoreWorries about rising inflation have spooked stock and bond investors. As a reminder, inflation occurs when the prices of goods and services rise and as a result, every dollar you spend in the economy purchases less. The annual rate of inflation over from 1917 until 2017 has averaged just over 3 percent annually. That might not sound like much, but consider this: today you need $7,272.09 in cash to buy what $1,000 could buy in 50 years ago.

Read More