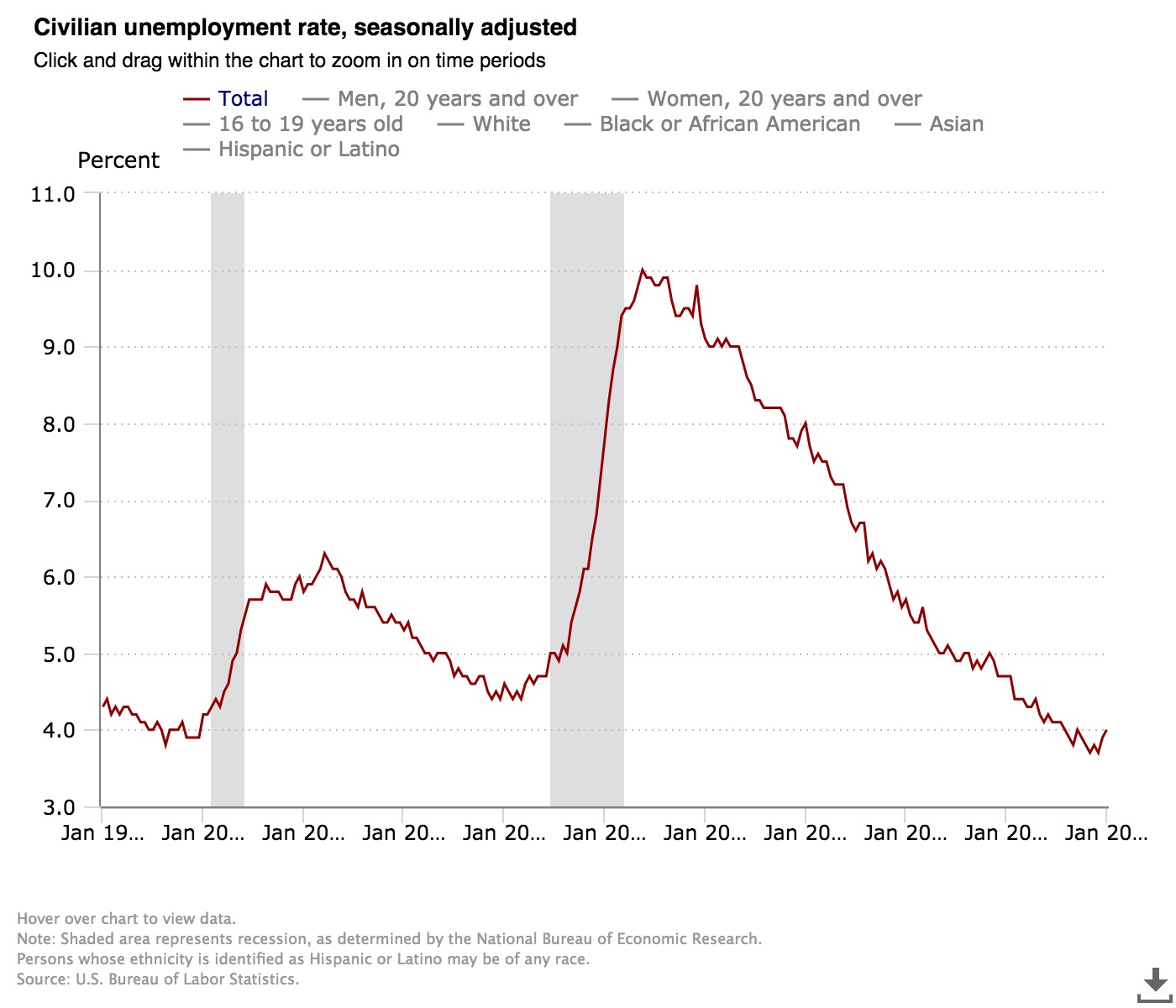

The economy added a better than expected 225,000 jobs in January and with revisions to the two prior months, the three-month average is 211,000, a strong showing for the eleventh year of an expansion.

Read MoreRemember way back in August, when economists and investors were gnashing their teeth about a looming recession? For the last three months, economic data have mostly improved, underscored by the just-released boffo November jobs report.

Read MoreThe September jobs report rescued what was shaping up to be a tough week for investors. After one measure of U.S. manufacturing fell to a decade low in September and a separate service sector index dropped to a three-year low, the Labor Department reported 136,000 jobs were added in September.

Read MoreWhile many were enjoying an extended break last week, there was good news and bad news on the financial independence front. For the economy, independence from a Federal Reserve rate cut proved to be the right course of action, at least for now.

Read MoreStocks reversed multi-week losses and you can thank Federal Reserve Chairman Jerome Powell. The week began with hand wringing over the potential Mexican tariffs. On Tuesday, Powell announced that the central bank was keeping an eye on trade developments, their impact on the U.S. economy, and would “act as appropriate to sustain the expansion.”

Read MoreAs weather watchers were preparing for Groundhog’s Day, economists were equally focused on whether the shadow of the government shutdown would impact the January employment report. They need not have worried.

Read MoreIt was an exhausting week for investors, even though there were only four trading sessions. Monday’s U.S.-China 90-day trade “time out” stock bounce was dwarfed by big sell-offs throughout the rest of the week. The drubbing began after the President’s tweet that he is a “tariff man,” shortly followed by another, which questioned whether a “real deal” with Beijing is actually possible.

Read More